Sport

Dollar

38,2552

0.34 %Euro

43,8333

0.15 %Gram Gold

4.076,2000

0.31 %Quarter Gold

6.772,5700

0.78 %Silver

39,9100

0.36 %Ghana's dollar bonds rallied on Monday after the ruling party's candidate conceded the December 7 presidential election.

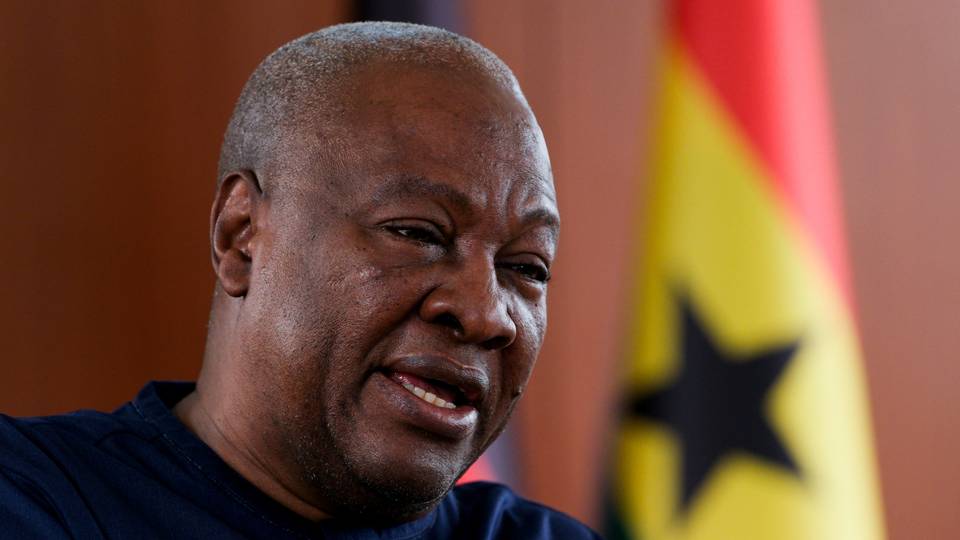

Ghana's dollar bonds rallied on Monday after the ruling party candidate conceded Saturday's presidential election to his opposition rival John Mahama.

The 2035 maturity led the gains, rising nearly 1 cent to bid at 74.31 cents on the dollar. Ghana's cedi currency was stable against the dollar.

Investors were betting that Mahama, who served as president from 2012-17, would not abandon the current financing programme with the International Monetary Fund despite campaign promises to renegotiate its terms.

"Investors will now focus on what Mahama will do in office ... Crucially, we would expect broad continuity of the IMF programme," said Tellimer's Stuart Culverhouse in a research note.

Defaulting

Mahama's pledge echoed those of other reformist candidates who have been elected into office in emerging markets this year, including Sri Lanka's Anura Kumara Dissanayake, who rode on a promise of reconsidering the terms of an IMF programme and debt restructuring.

Ghana, a West African gold and cocoa producer, defaulted on most of its external debt in 2022, leading to a painful restructuring.

The corresponding economic crisis fuelled voter anger against the outgoing government as individuals and households reeled from soaring inflation and a fall in the cedi.

An IMF spokesperson said Ghana had made "remarkable progress" on its debt restructuring, and that any government, including Ghana's, "may discuss changes with the IMF while ensuring that the economic objectives of the reform programmes are still achievable."

Fiscal deficit

Mahama, who was leading with more than 50% of votes, according to early results from local media and his party on Sunday, wants to introduce a public debt ceiling to curb over-borrowing, and to offer locals more ownership of upcoming oil and mining projects.

"The coming fortnight could be quite uncertain for financial markets," said Barclays analyst Michael Kafe in a note to clients, citing potential revelations of a worse fiscal position than reported, especially the deficit.

The new government could bring forward its maiden budget from March, he said, after the outgoing administration failed to enact a short-term spending plan to last through the transition, as is the norm.

➤ Click here to follow our WhatsApp channel for more stories.

Comments

No comments Yet

Comment