Sport

Dollar

38,2552

0.34 %Euro

43,8333

0.15 %Gram Gold

4.076,2000

0.31 %Quarter Gold

6.772,5700

0.78 %Silver

39,9100

0.36 %The International Monetary Fund (IMF) continues to face razor-sharp criticism over its tough loan conditions, especially on African countries.

By Brian Okoth

The International Monetary Fund (IMF) faces accusations of imposing difficult conditions on developing countries – most of them in Africa – in exchange for loans.

Those conditions are said to have far-reaching consequences on the borrower countries, including interference with internal governance, sinking nations deeper into debt, and creating a larger pool of poor people.

Kenneth Rogoff, an American professor who worked as IMF's chief economist, says the lender gives loans to countries with "exploding debt-to-GDP ratios."

Simply put, the IMF extends loans to countries already struggling with existing debts.

'Unsustainable'

Rogoff gave the example of Ghana, which was already in debt distress in 2021, but the IMF gave it a loan of $1 billion for post-COVID-19 recovery.

The IMF, in its assessment report of Ghana in July 2021, said: "While noting that risks to Ghana's capacity to repay have increased, IMF's executive directors concurred that they are still manageable."

In May 2023, the IMF added Ghana a $3 billion loan despite describing the country's debt as "unsustainable."

The funding was extended after Ghana defaulted on $30 billion loans in December 2022.

Tough loan conditions

But even as the IMF faces accusations of sinking debt-distressed countries, questions about its tough loan conditions continue to be posed.

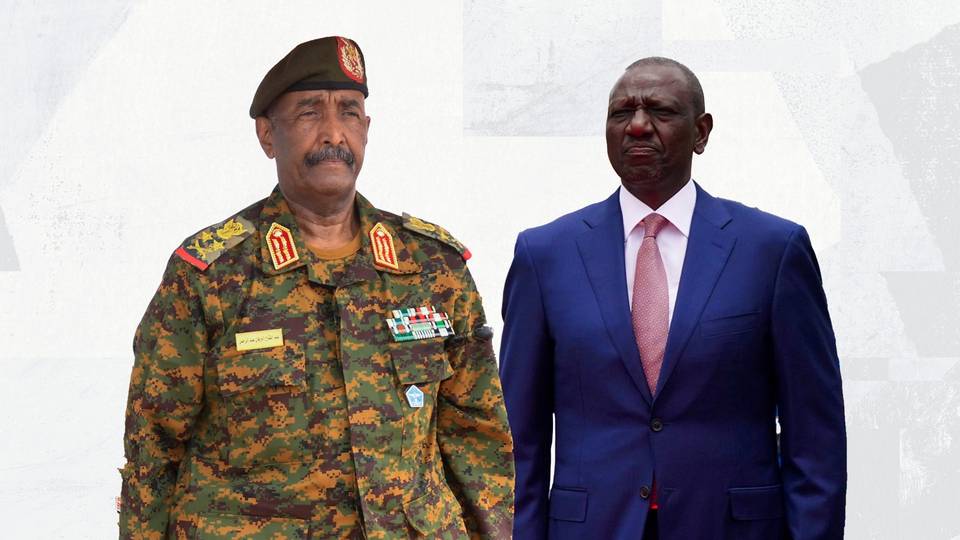

During the deadly protests in Kenya recently, the demonstrators, most of them young people, accused the IMF of having a hand in the contentious Finance Bill 2024 that would have increased the cost of imported sanitary towels, as well as mobile phones and motorcycles.

In the finance bill, which has since been rejected, Kenya was seeking to raise an additional 346 billion shillings ($2.7 billion) in revenue, with President William Ruto saying the extra money would help improve Kenya's health care, education, agriculture, among other sectors.

Kenya and the IMF are in talks for the lender to extend new credit to the East African nation.

Image 'severely dented'

The lender had reportedly set some conditions, including calls for more revenue, before extending loans to the East African nation.

Macharia Munene, a professor of international studies at the United States International University-Africa in Kenya, says the IMF's image among Kenyans has been "severely dented" following the recent developments.

"IMF's officials should rethink their strategy, and embrace more flexibility when dealing with governments, especially those in the developing world," Munene told TRT Afrika.

"The Kenyan situation has proven that their (IMF's) involvement in internal governance of countries is not something that is well received. They should try not to make it apparent that they are imposing certain conditions on governments," Munene added.

'Matchstick on explosives'

In June 2023, Tunisia's President Kais Saied rejected IMF's conditions for a $2 billion bailout.

The IMF had asked Tunisia to restructure over 100 state-owned companies and remove subsidies on food and fuel.

In June 2023, the president said IMF's conditions were like "putting a matchstick on explosives."

In Kenya, the IMF had, in July 2022, asked the East African nation to remove maize and fuel subsidies introduced by the then-President Uhuru Kenyatta.

Revenue shortage

Upon assuming office in September 2022, President Ruto removed the subsidies, saying they were an economic burden.

In December that year, IMF approved Kenya's $450 million loan request.

IMF says fossil fuel subsidy is the main reason for high carbon emissions and revenue shortage.

In its May 2019 report, the lender said if there were no fuel subsidies, global carbon emissions would have been 28% lower, and tax revenues higher by 3.8% globally.

'Structural problems'

The IMF says its preconditions, including calls for more taxes, are aimed at removing "structural problems that may hamper economic stability."

On average, there are about 25 conditions before an IMF loan gets approved.

A study done by researchers from the universities of Cambridge and Oxford, showed that between 1995 and 2014, the conditions IMF had imposed on 16 West African countries caused governments there to reduce health care budget.

The IMF extends two types of loans – a "lending arrangement and an outright loan." A lending arrangement requires the borrower to meet conditions before getting a loan, while an outright loan does not have preconditions.

People living in poverty

In the early 1980s, many African leaders took IMF and World Bank loans. Conditions, including cuts on social spending, were set.

A World Bank report, subsequently, showed the number of people living below a dollar daily in Sub-Saharan Africa doubled from 164 million to 316 million between 1981 and 2001.

IMF's funds mainly come from the lender's 190 member countries.

Each member is allocated a quota, which is the maximum amount of money it can contribute based on how the IMF classifies its economy. Developed nations have much higher quotas.

Voting power

For instance, the USA's quota is over 830,000, while Kenya's is 6,900.

Quotas are a key determinant of the voting power at the IMF as well.

The US, Japan, China, Germany, France and the UK have the most shares.

The IMF also gets an income from interest it charges on loans. Currently, the lender charges as high as over 8% annually in interest.

Standard currencies

Wealthy member states can pump more funds to IMF under an agreement called New Arrangements to Borrow, which is another funding model for the IMF.

Countries in need of loans can then get funding from the extra money pumped in. Interest charged on the borrower countries, is then added to the wealthy nations' quotas, further raising their shares.

Countries can also repay loans using gold. Today, the IMF holds over 2,800 metric tonnes of gold.

The lender's standard currencies are the US dollar, euro, Chinese yuan, Japanese yen and the UK pound.

African countries most-indebted to IMF

Currently, the IMF has financial resources worth about 1$ trillion.

The total amount owed to the IMF as of June 2024 was $147 billion. Out of the 94 countries that owe IMF funds, 48 are from Africa.

Egypt owes IMF the most in Africa, with a loan portfolio of $10.3 billion. The other African countries whose loans are above $2 billion are Angola, Ghana, Kenya and Côte d'Ivoire.

Others with over $1 billion in loans are Nigeria, Cameroon, the DRC, Morocco, Senegal and South Africa.

➤ Click here to follow our WhatsApp channel for more stories.

Comments

No comments Yet

Comment